Hi! I’m Abi, I'm currently studying a masters in Criminology and Criminal Justice. I like to draw animals & wildlife, play video games, and I like reading.

Budgeting Tools

Trying to budget while studying at University can be really tricky, when I first started in 2018 I was awful…

January 10, 2023,

read.

Trying to budget while studying at University can be really tricky, when I first started in 2018 I was awful with my finances and often found myself completely broke in the weeks leading up to a Student Finance payment. I know a lot of people are in the same situation, and it can be especially difficult if you haven’t had to manage your own money before. I’m going to run through the most important things I learned on my budgeting journey in the hopes of sparing you the same stress!

Organisation is key

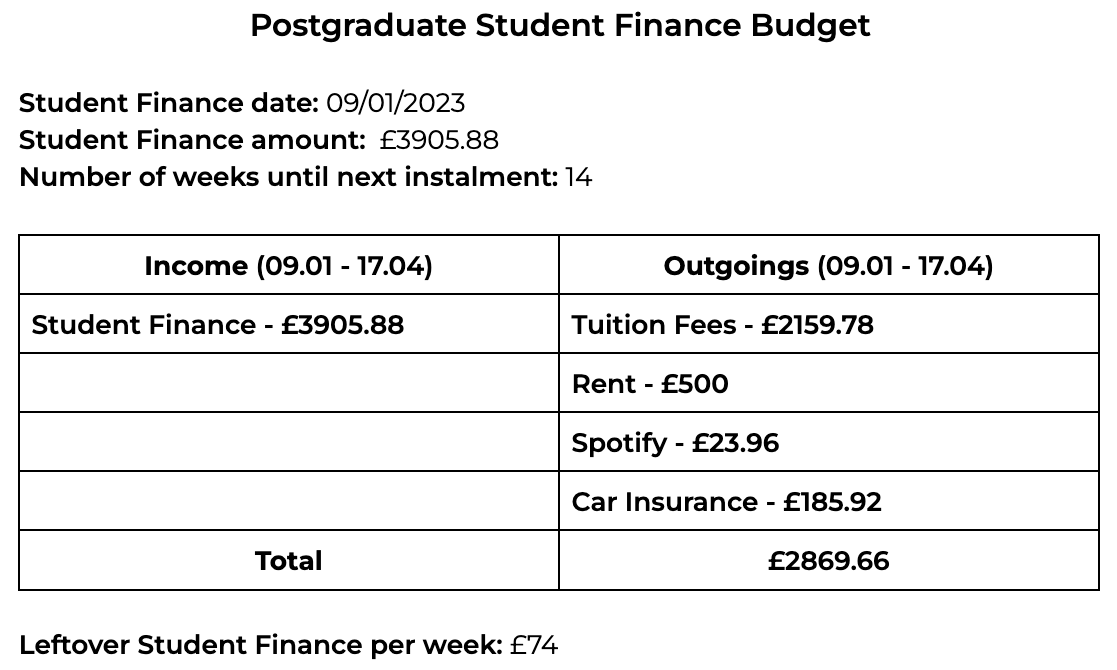

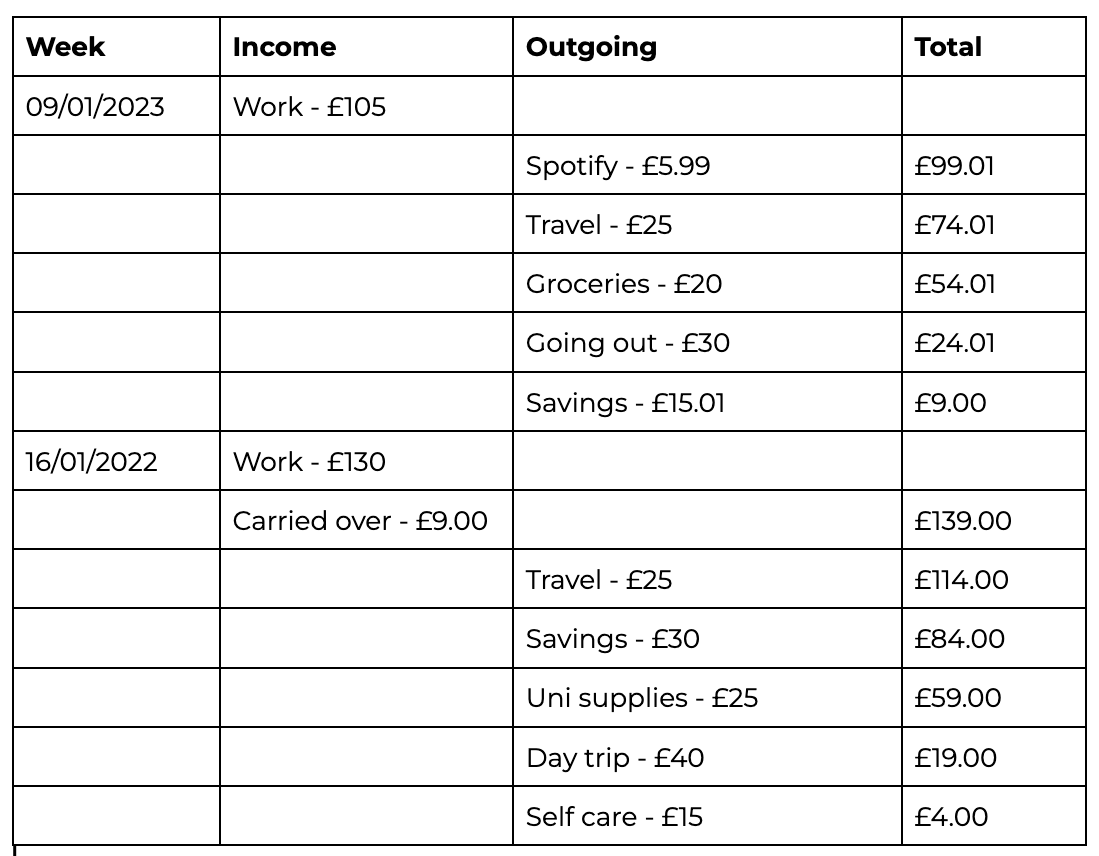

Pre-planning your money and creating a plan is one of the best things you can do, I’d recommend using a budgeting sheet or creating a google doc that you can keep a track of. Here’s an example of how I sort my student finance payments.

Mine will probably look a lot different to yours, for example, I live at home so my rent is a lot cheaper, and I’m a postgraduate student so I have to pay my tuition fees out of my loan. This aside, the main point stays the same, deduct what you have to pay out for the entire student finance period, then work out how much you have left over. This doesn’t include any earnings you may have, especially if they change every week.

It’s okay if you don’t have any student finance left after paying your rent and other bills, any other income can be organised in a different way. Here’s a quick example of how you can budget any weekly incomings and outgoings.

Bank Accounts

Some mainstream banks can be very plain and featureless, however, there are some newer banks which have budget-friendly features to help you save! I currently use Monzo, which allows me to create pots to separate my money, which ensures I won’t overspend. You can also lock pots if you don’t want to be able to access your money until a certain date, but if you need the money sooner for any reason you can access it after a 24-hour waiting period. This helps to make sure you won’t make any impulse purchases, but I wouldn’t recommend locking any money away that you might need in an emergency.

Monzo also has a spending tracker which follows the trends of your spending habits and alerts you if you’re going over your self-set budget. This has helped me stay on top of my spending and also given me a well-needed reality check on where my money was going.

A top tip when it comes to your bank account is to regularly check your available balance. I make sure to check how much money is in my account before I make any purchases so I know exactly how much I can spend (or perhaps how much I can’t spend).

Another bank worth an honourable mention is starling, which has a few budgeting tools available for users such as a bills tracker. Through the bills tracker, you can keep an eye on any outgoings you have coming up, and this is excluded from your main balance to help you keep a cap on your spending.

Budgeting Apps

There are many good budgeting apps out there, however, a lot of them have their most useful features locked behind a paywall. I don’t want to recommend spending more money to save, so I’m going to run through how you can manually do what budgeting apps do for you.

Check for unused subscriptions

This is a great way to save some money, I’d recommend looking through a month or two of your bank statements and looking to see if there are any subscriptions you aren’t using. If you live with housemates and all use the same Netflix account, why not split the cost to make it cheap for everyone?

Calculate your spending habits

As previously mentioned, some banks like Monzo will track your spending habits for you, but if your bank doesn’t have this feature you can do it yourself! Go through your bank statement every month and total up how much you’ve spent on fast food, groceries, subscriptions, nights out, etc. This will help you see where you need to cut back and then you can set a reasonable spending limit for upcoming months.

Check your account regularly

I cannot stress this enough – the best way to stay on top of your spending is to be aware of how much money you have at all times, this way you won’t accidentally go into your overdraft or overspend your budget. Checking your account can be daunting, and it definitely caused me a lot of anxiety at first, but the more you do it the easier it will get.